The procedure of recording transactions in a triple/three-column cash book is similar to that of a double-column cash book. The only difference between two types of cash books is that a double column cash book has two money columns (i.e., cash and bank), whereas a triple column cash book has three money columns (i.e., cash, bank, and discount). Expense accounts show money spent, including purchased goods for sale, payroll costs, rent, and advertising. For example, you overpaid your electric bill in error last month, and you receive a refund of $200.00 from the electric company.

Blockchain: Research and Applications

Additionally, the blockchain can create smart contracts that automatically execute when certain conditions are met. This can help reduce fraud risk by ensuring that agreements are carried out as intended. While there are many potential audit-IT points for blockchain technology, some of the key considerations include data governance and controls, identity management, and cryptography.Data governance and controls are essential for ensuring that the data stored on a blockchain is accurate and can be relied upon.

“Triple-entry accounting” also found in:

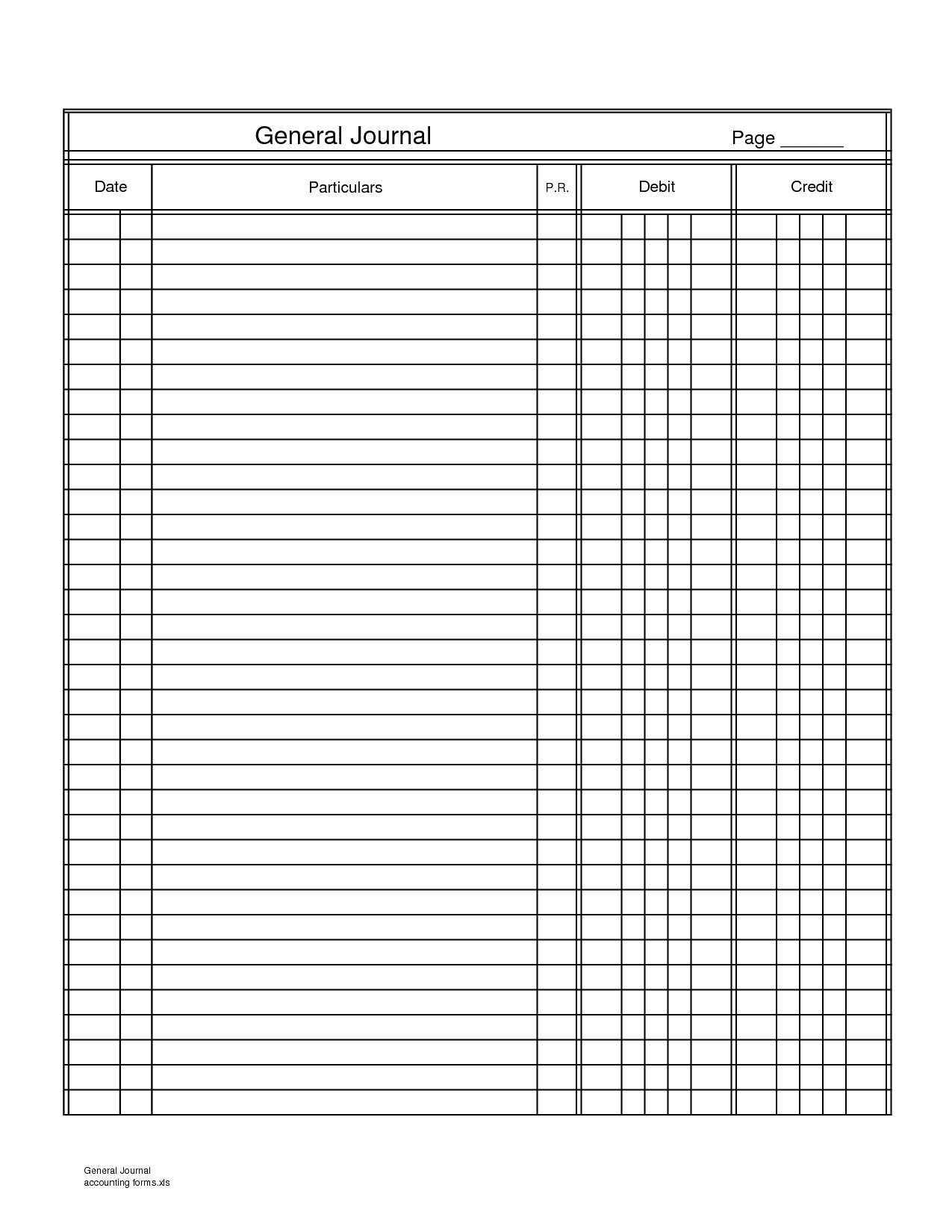

In the triple-entry system, B writes a ‘receipt’ on a third shared ledger with a signature. As long as the internal record of such a third entry is immutable, neither A nor B can change it later in their ledgers. First, we will debit the expense (to increase an expense, you debit it); and then, credit Cash to record the decrease in cash as a result of the payment. For additional practice in preparing journal entries, here are some more examples of business transactions along with explanations on how their journal entries are prepared. Which leads triple journal entry to the pairs of double entriesconnected by the central list of receipts;three entries for each transaction.Not only is each accounting agent led tokeep three entries, the natural rolesof a transaction are of three parties,leading to three by three entries. Within the full record of the signed receipt,the user’s intention is expressed, and isfully confirmed by the server’s response.Both of these are covered by digitalsignatures, locking these data down.A reviewer such as an auditor can confirm thetwo sets of data, and can verify the signatures.

What is Triple Entry Accounting?

A traditional database requires a centralised administrator to control the data/records and is also permissioned, which means the administrator sets privileges regarding how users can access a database. There is an increase in an asset account (Furniture and Fixtures) in exchange for a decrease in another asset (Cash). Local Entry Storage and Reports.The persistent saving and responsive availabilityof entries.In practice, this is the classical accountinggeneral ledger, at least in storage terms.It needs to bend somewhatto handle much more flexible entries,and its report capabilities become more keyas they conduct instrinsic reconciliationon a demand or live basis. Simple examples will help.When Alice forms a transaction, she enters it into her software.Every GLT transaction requires naming her externalcounterparty, Bob.

They are also secure and transparent, meaning that anyone can view the balances and transactions of any account on the blockchain. This makes them ideal for online transactions and makes them perfect for use in digital cryptocurrencies. It is difficult to say whether or not blockchain technology can replace chartered accountants.

(i) Every transaction has two fold aspects, i.e., one party giving the benefit and the other receiving the benefit. Entry Enlargement and Migration.Each new version of a message coming in representsan entry that is either to be updated or added.As each message adds to a prior conversation,the stored entry needs to enlarge and absorb thenew information, while preserving the other properties. The double-entry approach is so-named because each economic action calls for at least two accounting system impacts. Ken Boyd is a co-founder of AccountingEd.com and owns St. Louis Test Preparation (AccountingAccidentally.com). SoftLedger, a modern full-featured accounting system with crypto-specific features.

Assuming acceptance, hissoftware can then respond by sendingan acceptance message to Ivan.The STR now assembles an acceptedinvoice record to replace the earlierspeculative invoice record and posts that threeways.At some related time (to do with payment policy)Bob also posts a separate transaction to pay for theinvoice. This could operate in much the same way asa separate transaction, linking directly to theoriginal invoice. Double Entry bookkeepingadds an additional importantproperty to the accounting system;that of a clear strategy to identify errorsand to remove them.Even better, it has a side effect ofclearly firewalling errors as eitheraccident or fraud. Doing so can help you save money through taxes, produce accurate financial statements like …. Essentially, what Yuji has done is taken the familiar concept that the change in Wealth is equal to Income (effectively the same as the standard accounting formula) and added on some new concepts to provide more information about where the organization is headed. The idea is that accounting could be fundamentally tied to forecasting and, therefore, enable better strategic decision making.

- This may record what the product was, the prices, who the seller is, who is the buyer is, all digitally signed.

- Accountants frequently review the trial balance to verify that they posted journal entries correctly, as well as to correct any errors.

- SoftLedger, a modern full-featured accounting system with crypto-specific features.

- From those foundations, Boyle concluded thattherefore what is needed is a shared access repositorythat provides arms-length access.

This type of accounting is ideal as it creates an immutable history of all the exchanges within the system which could be extracted using reporting tools thus providing a perfect audit trail, automatically and in a trustless manner. Triple entry is quite a confusing term because we’re not creating a third entry we’re just linking the separate double entries. The advantages of a triple entry system are enormous in terms of reconciliation, transparency, trust and auditing.

The company should debit $5,000 from the Wood-Inventory account and credit $5,000 to the Cash account. So to put it simply, double-entry bookkeeping allows you to keep more diligent, accurate records. As your business grows and you begin to have different accounts on your books, a double-entry system will allow you to track your cash flow better. There is evidence that even during the Mesopotamian era some four or five thousand years ago a fairly complex accounting of property purchases and expenditures existed on tablets.

As a result, data is consistent and reliable across companies because everyone has equal access to it. The total of the trial balance should always be zero, and the total debits should be exactly equal to the total credits. When you generate a balance sheet in double-entry bookkeeping, your liabilities and equity (net worth or “capital”) must equal assets. As we end up witha logical arrangement of three by three entries,we feel the term triple entry bookkeepingis useful to describe the advance on the older form. What causes confusion is the difference between the balance sheet equation and the fact that debits must equal credits.

Extensive accounting methods also existed in Greece since the fifth century BC, and by the Middle Ages, a fairly advanced system of accounting was developed. But before the advent of double-entry accounting, accountants relied on the chart of balance sheet accounts to record financial transactions. This single-entry accounting system is a method of bookkeeping relying on a one-sided accounting entry to maintain financial information, which creates a system that it’s very difficult to examine for accountability especially considering the extreme problems such a system would pose today.

Deje su comentario

Debe iniciar sesión para escribir un comentario.